The beauty of a bond portfolio is no matter what the economic outlook, the portfolio can be constructed to best suit the conditions. Here we look over three bond portfolios that have been created to optimise performance in different economic environments:

sustained inflationary pressures, recessionary concerns and also a balanced portfolio for all weathers.

Background

Direct bond ownership allows an investor the flexibility to hold a portfolio that best reflects their economic outlook, and the ability to easily tweak exposures to match the changing economic landscape.

We’ve created these portfolios to match some of the key concerns investors are currently facing, one being sticky higher inflation and another a potential hard economic landing, where the portfolios will continue to offer a steady income stream,

where other asset classes would see this eroded. We’ve also included a balanced portfolio, which will still offer a level of inflation protection and defensiveness, as well as a high yielding component to achieve a higher return.

Here we discuss each different portfolio in further detail.

Inflation

Although the June quarter headline inflation rate slowed to 6.1% annualised, it still remains elevated. Furthermore, the Reserve Bank of Australia’s (RBA) recent Statement on Monetary Policy doesn’t see inflation returning to within the target

range of 2%-3% before mid-2025.

With this in mind, protecting returns against eroding inflation is an important consideration for investors. It is also worth noting that not all asset classes offer relatively low risk returns above 6.1%.

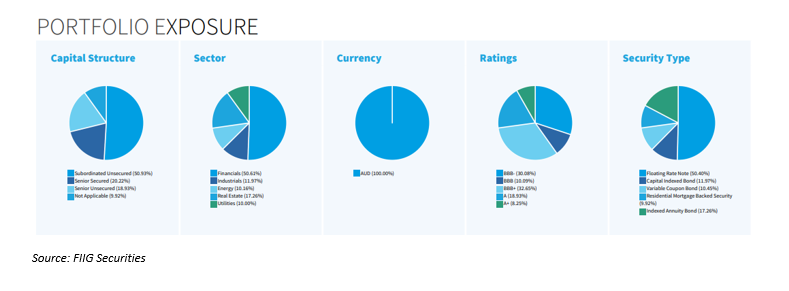

The Inflation portfolio has been constructed based on a $514k spend across 10 different bonds, allowing for $50k face value of each. This can be modified to suit a lower investment amount.

To keep pace with inflation, the portfolio has a larger allocation to inflation linked bonds, and achieves a return above inflation. The overall yield to the assumed maturity date is 6.32%, while still having a 100% investment grade allocation.

Capital Indexed Bonds (CIB) and Indexed Annuity Bonds (IAB) offer inflation protection by keeping the cashflow paid to investors in step with the rate of inflation. As such, during times of higher inflation, the coupon payments increase to keep pace

with inflation.

In this portfolio we have included an 11.97% allocation to CIB bonds and a 17.26% allocation to IAB bonds. The inflation assumption in the calculated yield is just 2.5%, being the mid-point of the RBA target band, but clearly a lot lower than current

levels. The bonds included using this assumption are the Sydney Airport 2030 (CIB) that yields 5.97%, Jem NSW Schools (IAB) that yields 5.78% and Royal Women’s Hospital (IAB) that yields 5.49%.

To achieve a higher return while remaining in the investment grade space we included a Residential Mortgage Backed Security (RMBS), the Pepper 2023 -36PP Class C notes, which provides the portfolio a higher monthly income and a projected indicative

yield over 7.00%.

We also favoured higher margin floating rate notes over longer dated fixed rate bonds, which will perform well in a higher interest rate and inflationary environment. Not only will they offer capital price stability if rates creep higher, but also

provide a larger quarterly coupon with the 3 month Bank Bill Swap Rate (BBSW) also elevated.

Recession

An inverted yield-curve, as has been present in US government bonds for over a year although not quite in Australia yet, has long been considered an indicator for upcoming recessions, historically predicting prior occurrences. Although the unwinding

of ultra-low monetary policy may dispel this theory, it’s not something to be ignored.

Currently shorter-dated Australian government bond yields are higher than some longer dated tenors, potentially pointing to an economic slowdown. It remains to be seen if we’ll have a soft or hard landing.

While indicators build a case for each, a defensive fixed income portfolio will cater to whatever the scenario plays out.

This portfolio has been constructed based on a $505k spend across 10 different bonds, allowing for a $40k-$60K face value of each. Once again, this can be modified to suit a lower investment amount.

With a potential recession in mind, we constructed this portfolio with a higher credit quality and yields 5.37% to the assumed maturity date. We included some longer dated fixed rate government and semi-government bonds, which typically perform well

during such economic events.

We included the Queensland Treasury Corporation 2033 bond, which pays an attractively high 6.50% coupon, as well as the Australian Government 2047 and 2029 bonds, which hold the highest credit rating achievable from the credit rating agencies.

During ‘risk-off’ environments (typical of recessions), there is a widening of credit spreads (the premium investors demand to be paid for taking on additional perceived risk over the risk-free rate) and demand for ‘safer’

investments. This is generally why riskier assets under-perform during such times, while more defensive assets (such as government bonds) out-perform.

In this portfolio we also preferred longer dated fixed rate exposures, noting also that during such times the market will be pricing in rate cuts (if the RBA hasn’t already begun a loosening policy), which will see such fixed rate bonds increase

in capital price terms, all else being equal.

We included the Ausnet 2033 fixed rate bond, yielding over 5.60% and paying a 6.134% coupon, as well as the Challenger 2027c Tier 2 subordinated notes, which yields over 5.60% also and pays a 7.186% coupon.

Balanced

Another option is where an investor wants some inflation protection, defensive exposures, but is also chasing yield and income. A balanced portfolio can deliver just that, catering for a mix of environments.

We based this portfolio off a $509k spend, and once again across 10 different bonds with a $40-60K face value of each. It too can be adjusted for a lower investment amount.

With fewer higher quality exposures (unlike the recession portfolio), we could include some higher yielding options while still sticking to a 100% investment grade rated portfolio, and achieved a yield of 6.48% to the assumed maturity date.

We still included an IAB and CIB allocation to protect against inflation, with the Jem NSW Schools 2035 and Sydney Airport 2030 bonds appearing again. However we left out any government bond allocations.

This was more of a mix of higher margin floating rate notes, as well as longer dated fixed rate bonds. We included the Genworth 2025c Tier 2 subordinated notes, which pays a coupon of 5.00% over the 3M BBSW, as well as the Lendlease 2031 senior

unsecured bond, yielding around 7.00%. The latter is also a certified green bond, providing an ESG allocation to the portfolio.

Conclusion

We hope the above three portfolios have demonstrated the returns and types of bonds on offer to best construct a portfolio to meet a particular outlook. With every well-constructed portfolio, we offer and recommend frequent reviews to ensure it

still remains relevant and meets all investment goals.

In the case where economic conditions and views have changed, a position can be sold prior to maturity and a new bond exposure added.

While it remains impossible to predict what exactly is in store for financial markets and the wider economy, a well-constructed, diversified bond portfolio can weather all such conditions.